TL;DR: What could the new ranking formula for Universal Commerce Protocol look like?

Don’t have time to read the full blog? Try our summarize with AI buttons!

In an AI‑first, agentic shopping flow, the large language model (LLM) will constantly be asking itself at least three questions before it shows or buys anything:

“Do people actually like this product?” (product sentiment)

“Do people trust this brand?” (brand sentiment)

“Will this merchant fulfill reliably and fairly?” (merchant sentiment)

These sentiment layers would likely sit on top of the usual commerce fundamentals such as price, availability, shipping speed, returns, and are aggregated from reviews, user-generated content (UGC), expert content (thought leadership, industry studies), and historical outcomes (conversions, returns, complaints, etc.). When an agent fans out into the web and UCP‑enabled merchants, the combinations that score best across all three dimensions (or more) will be surfaced and purchased more often (ignoring paid UCP placements for the moment).

On the retrieval side, agents will almost certainly rely on multiple query fan‑outs per task:

Product‑context fan‑outs (researching what matters for this category)

Shopping fan‑outs (fetching concrete offers and prices)

Source‑credibility fan‑outs (which sites, reviewers, and merchants can be trusted)

In Google AI Mode specifically, these fan‑outs will increasingly hit live UCP endpoints instead of scraped shopping pages, reducing price mismatches and broken flows.

This is why AI‑first analytics platforms matter: they are the only ones fast and granular enough to show how models actually see your products, brand, and merchant experience, so you can react before competitors do. Understanding your AI sentiment today builds the data foundation you'll need when agentic commerce becomes the default — and gives you a head start while competitors are still figuring it out.

What UCP really means for online retailers (and why an AI‑first visibility strategy is now mandatory)

Universal Commerce Protocol (UCP) is quietly turning the “AI assistant that recommends products” into an “AI buyer” that can actually execute the transaction end‑to‑end. It is the missing interoperability layer that lets AI agents talk to merchants, payment providers, and order systems in a consistent way, very much like Anthropic’s Model Context Protocol (MCP) did for tools, but for commerce.

In this new agentic world, products, brands, and merchants will not win because of who shouts loudest, but because of how models and agents see them across three sentiments: product, brand, and merchant. Those three signals, combined with live data such as price and availability, will determine which product–brand–merchant combos agents choose when a user says, “Just buy it for me.”

Understanding the Universal Commerce Protocol

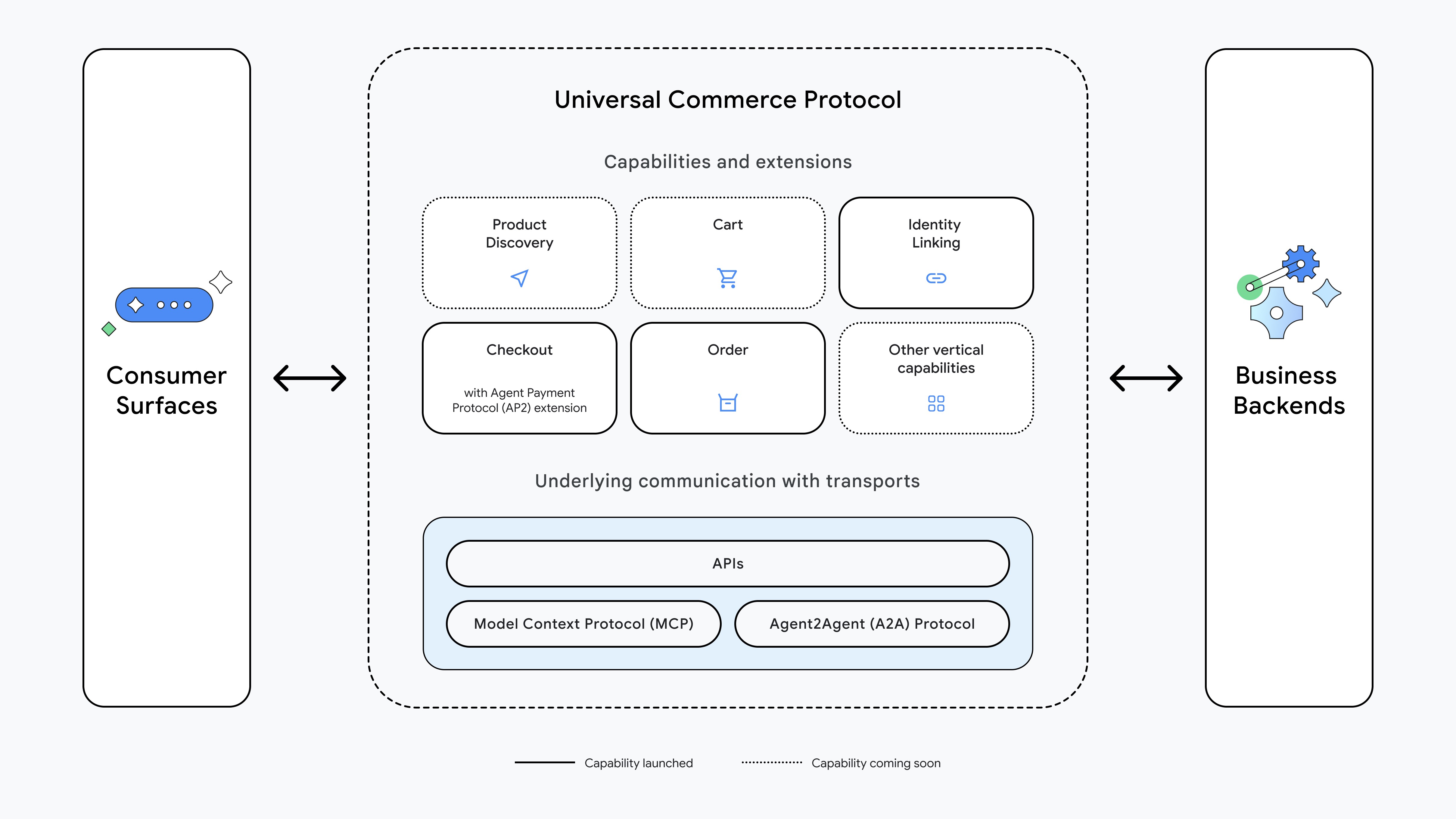

Image credit: Google Developers' Blog, high-level architecture of UCP

UCP is an open standard that defines how agents, merchants, platforms, and payment providers exchange commerce data and actions, such as catalogs, carts, checkout, identity, and orders. Instead of hundreds of custom integrations between every retailer and every AI touchpoint, UCP provides a shared, strongly‑typed commerce language with modular capabilities and extensions.

Conceptually, UCP does for commerce what MCP did for tools:

MCP gives models a consistent way to discover tools, understand their capabilities, and call them safely inside a conversation.

UCP gives agents a consistent way to discover merchants, understand what they support (checkout, shipping, returns, loyalty, etc.), and coordinate an end‑to‑end order lifecycle.

UCP itself won’t choose winners, instead it exists to make sure the agent always has accurate, real‑time data to work with when it makes ranking and buying decisions.

Why do we even need UCP?

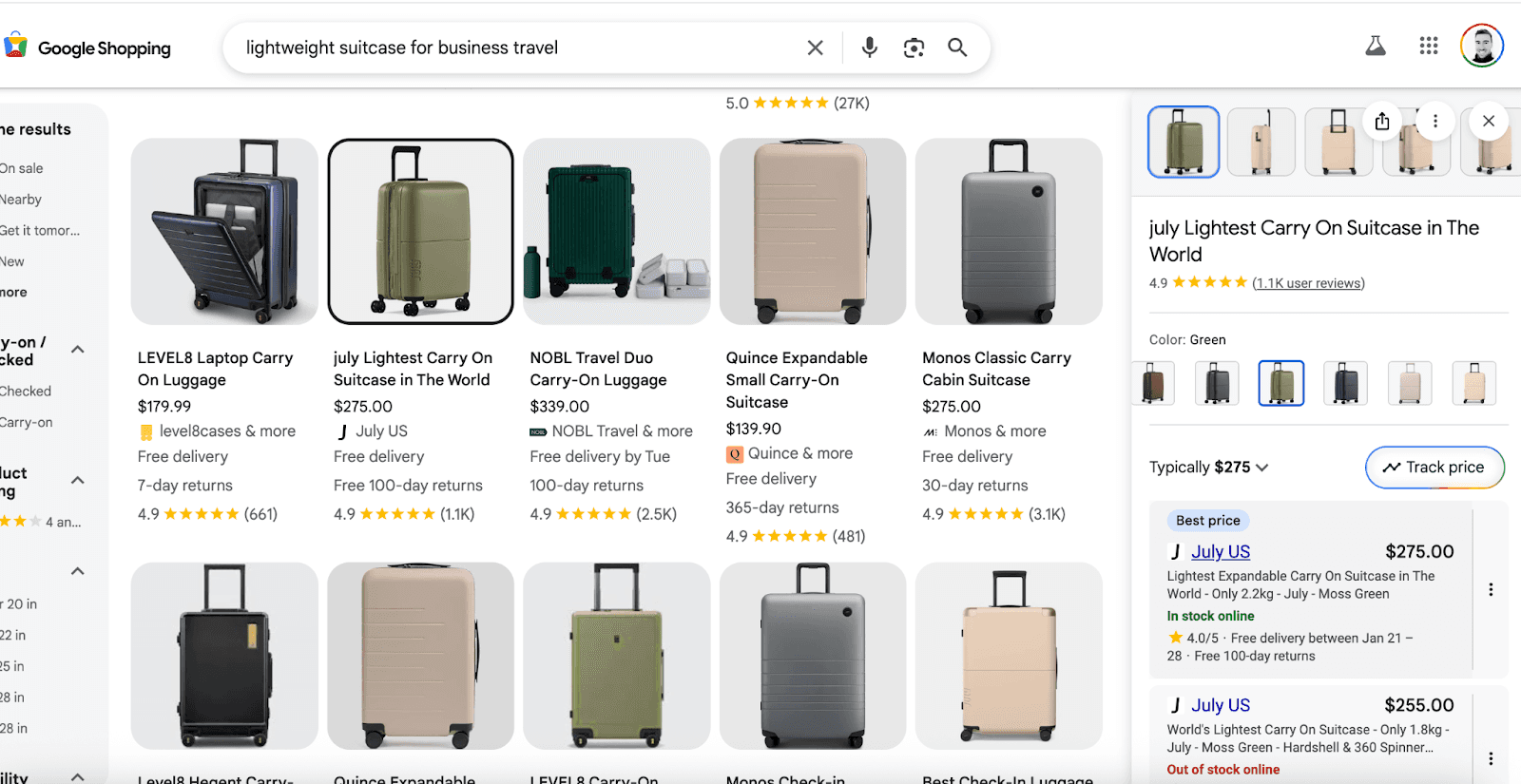

To see why UCP matters, consider a simple task: buying a lightweight suitcase for a business trip.

If you ask an AI assistant without direct access to Google’s Shopping Graph (such as ChatGPT) to recommend a suitcase and find the best price, it typically scrapes public shopping pages or affiliate feeds. It doesn’t have a direct integration with most merchants’ inventory and pricing systems. That causes several problems:

Prices are often out of date by the time the model sees them.

Stock status, shipping options, and local pickup availability are guesses at best.

Complex filters like “under $500, available within 10 km for pickup in 2 days” are hard or impossible to satisfy reliably.

Effectively, the assistant is transforming high‑quality 1st‑party merchant data into lower‑quality 3rd‑party data by using web scraping. That’s fine for general research (fair use policies aside for now), but terrible if you want the model to find live price, availability, and merchant credibility data on your behalf.

Let’s see a real example:

Note: While ChatGPT may have a direct integration with Etsy, for most carousel products it scrapes Google Shopping webpages and does not access Google Shopping Graph directly)

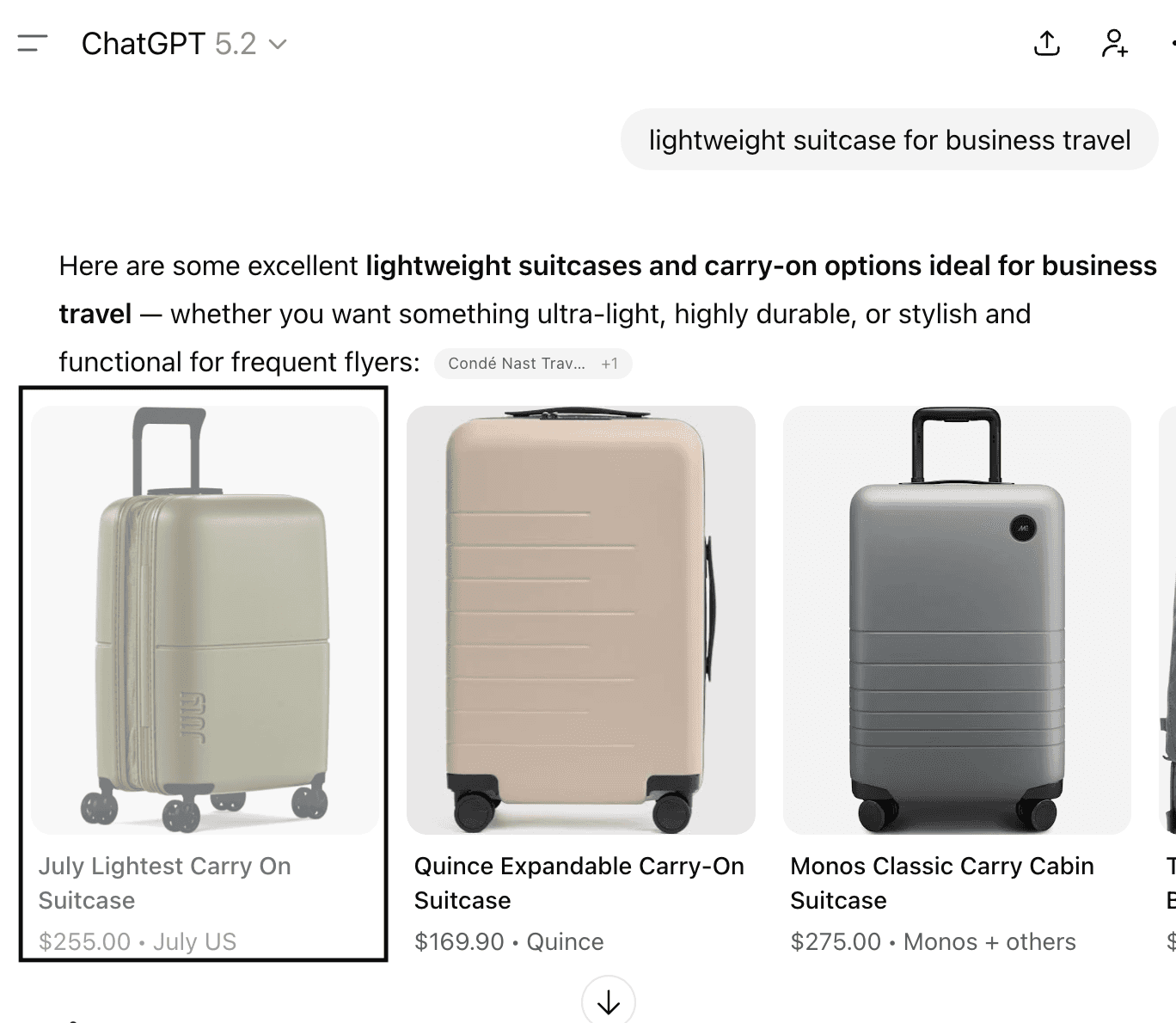

We asked ChatGPT to find a “lightweight suitcase for business travel”:

The large language model (LLM) researched the options, and a product carousel appears with seemingly live prices, reviews, and stock information.

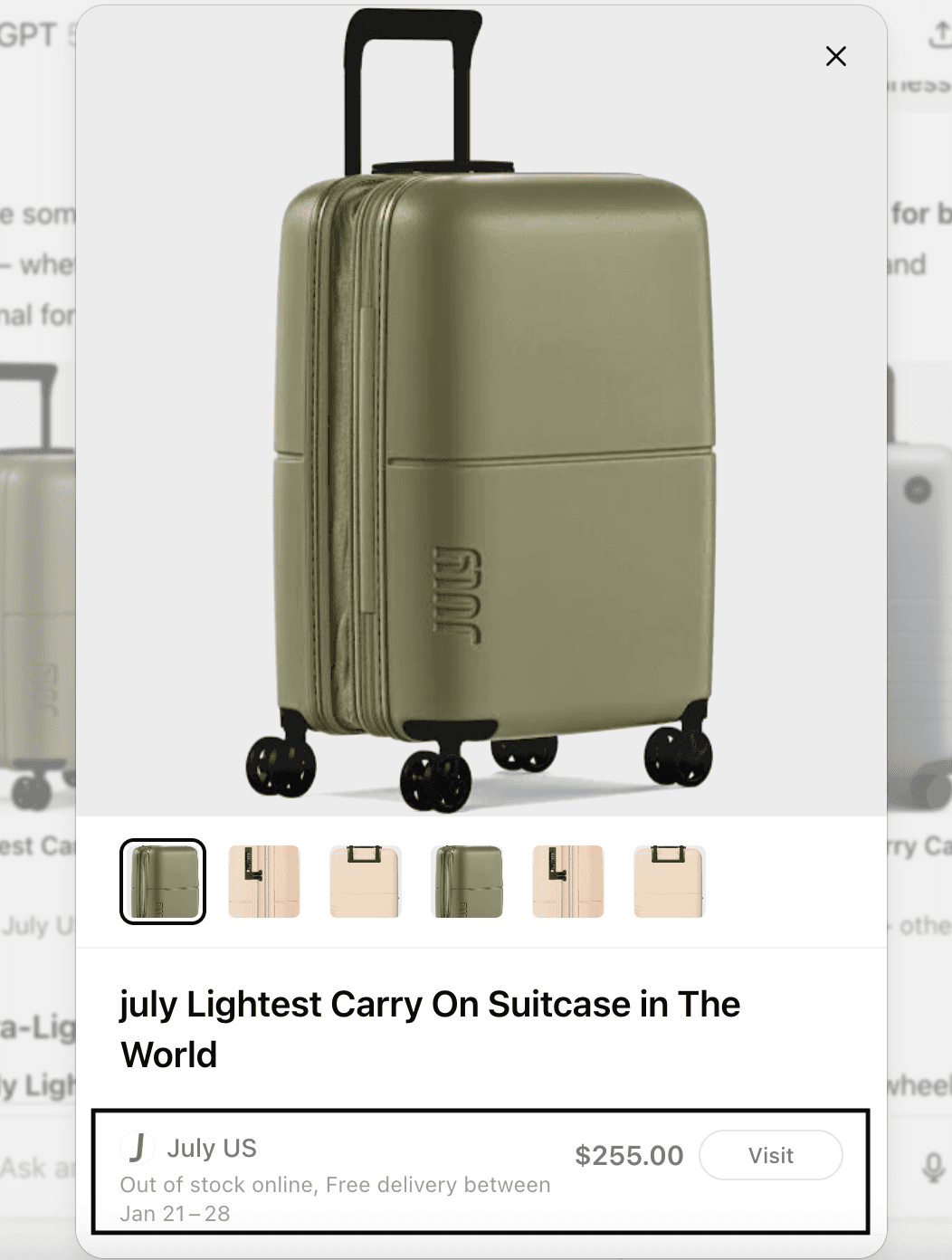

We clicked the first option in the carousel only to find it’s out of stock but we can order it online for next-week delivery.

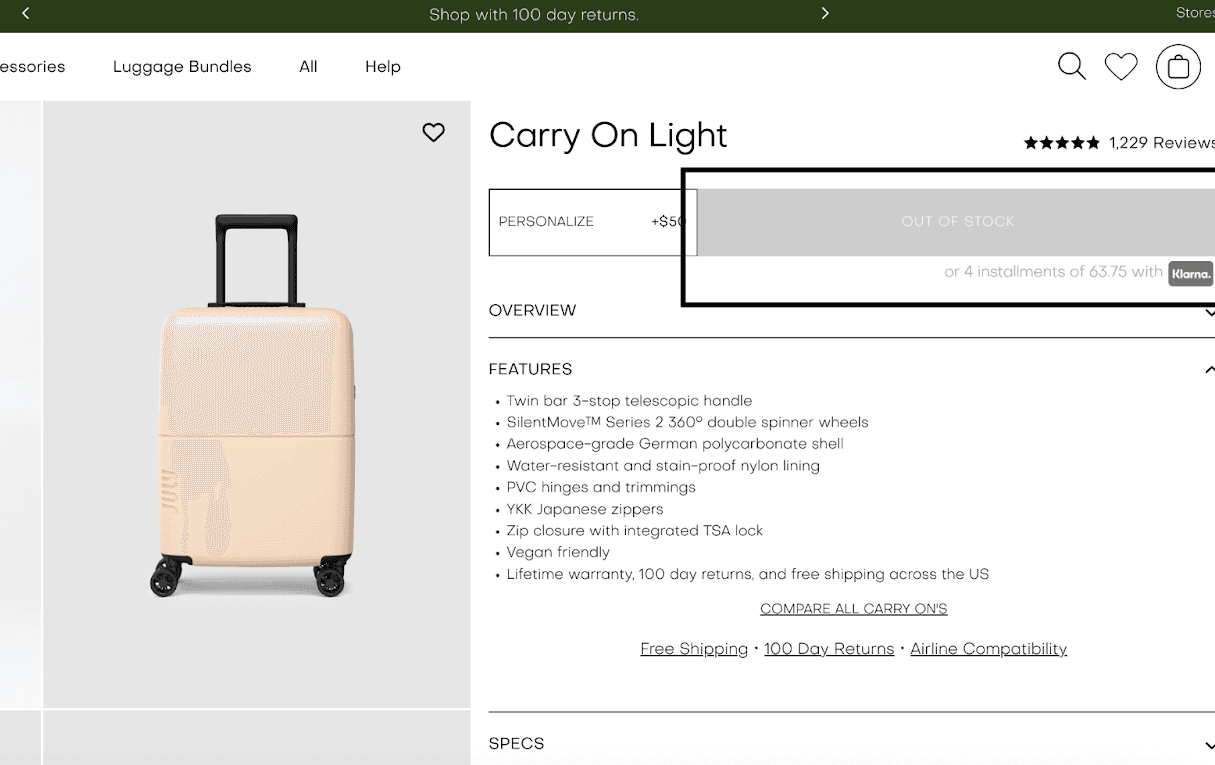

We click through to the merchant to try and place the order only for the suitcase to be both out of stock and us unable to place the order.

However, if we find the same listing on Google Shopping, we do see live prices and stock information.

We extracted the term ChatGPT used to query Google Shopping and ran that manually to compare the results:

We clicked on the link to the merchant and confirmed the suitcase is in stock and we can place an order.

This highlights the key advantage of Google Shopping Graph and querying live product data.

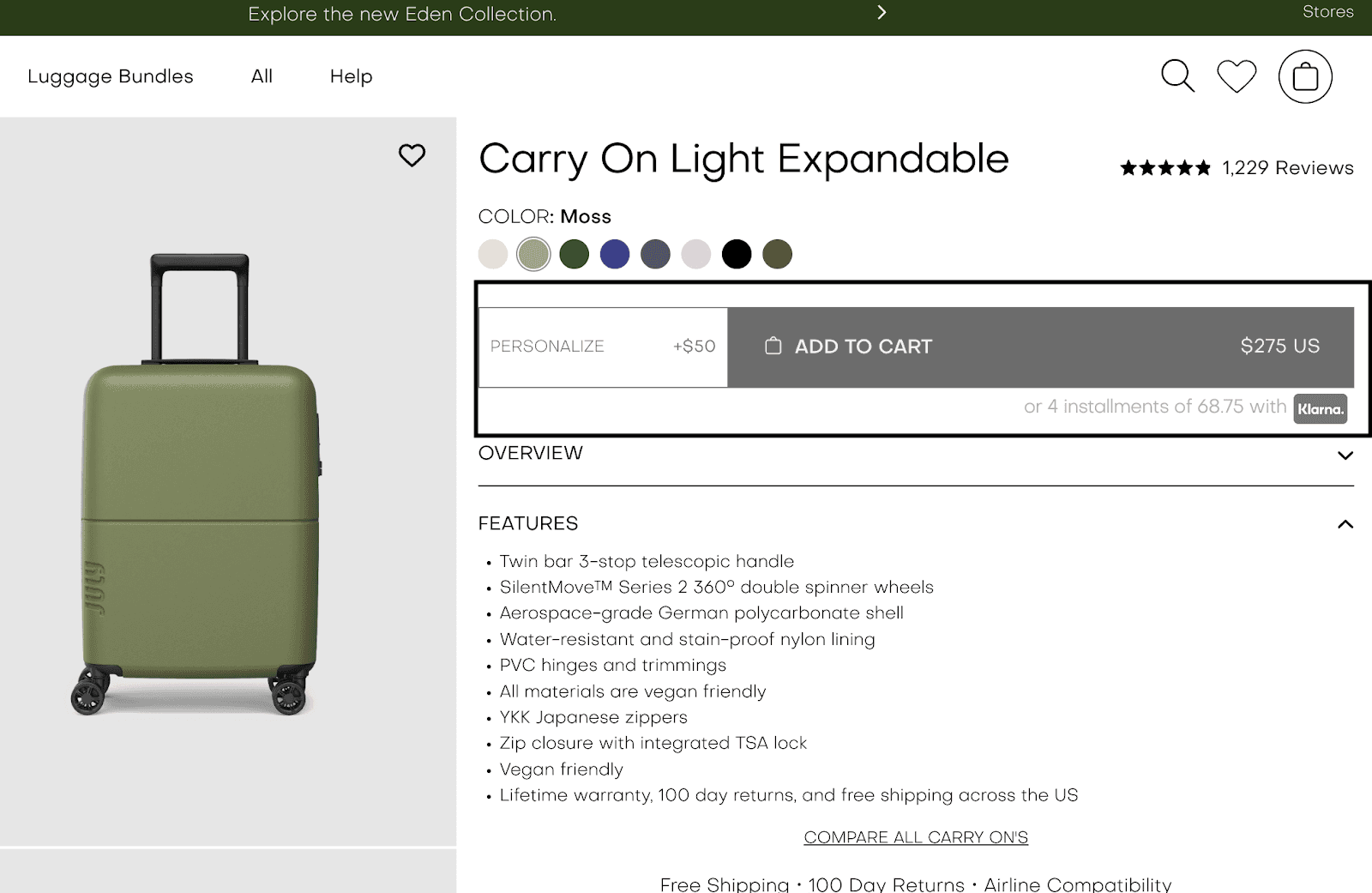

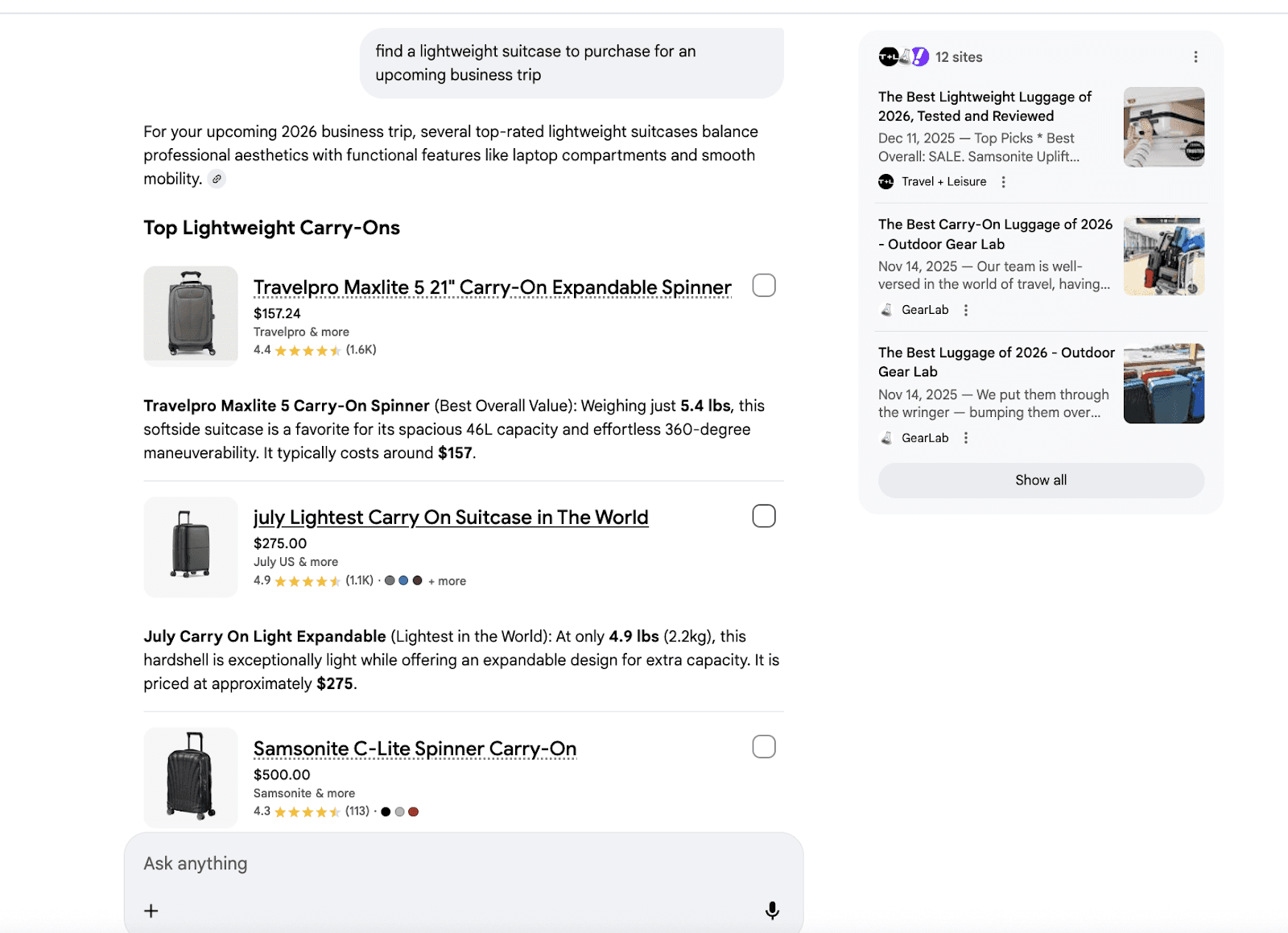

A real example from Google AI Mode today

As seen above, Google has a structural advantage because its results are backed by its Shopping Graph and related merchant feeds. This means, Google's AI Mode can often show prices and reviews that closer match reality. You get a list of options with:

Current prices and availability (based on what the Shopping Graph knows).

Ratings and reviews, often aggregated from multiple platforms.

But even here, the process is not fully agentic yet. When you click through to the merchant website, you can still see dramatic price mismatches or outdated offers. The AI view and the actual product page are loosely connected, but the user still has to:

Click through.

Check pricing and stock manually.

Complete a traditional checkout flow.

Let’s look at a real example you can try to test this out:

Search for a product in Google AI Mode, such as the lightweight suitcase for a business trip, and browse the surfaced listings.

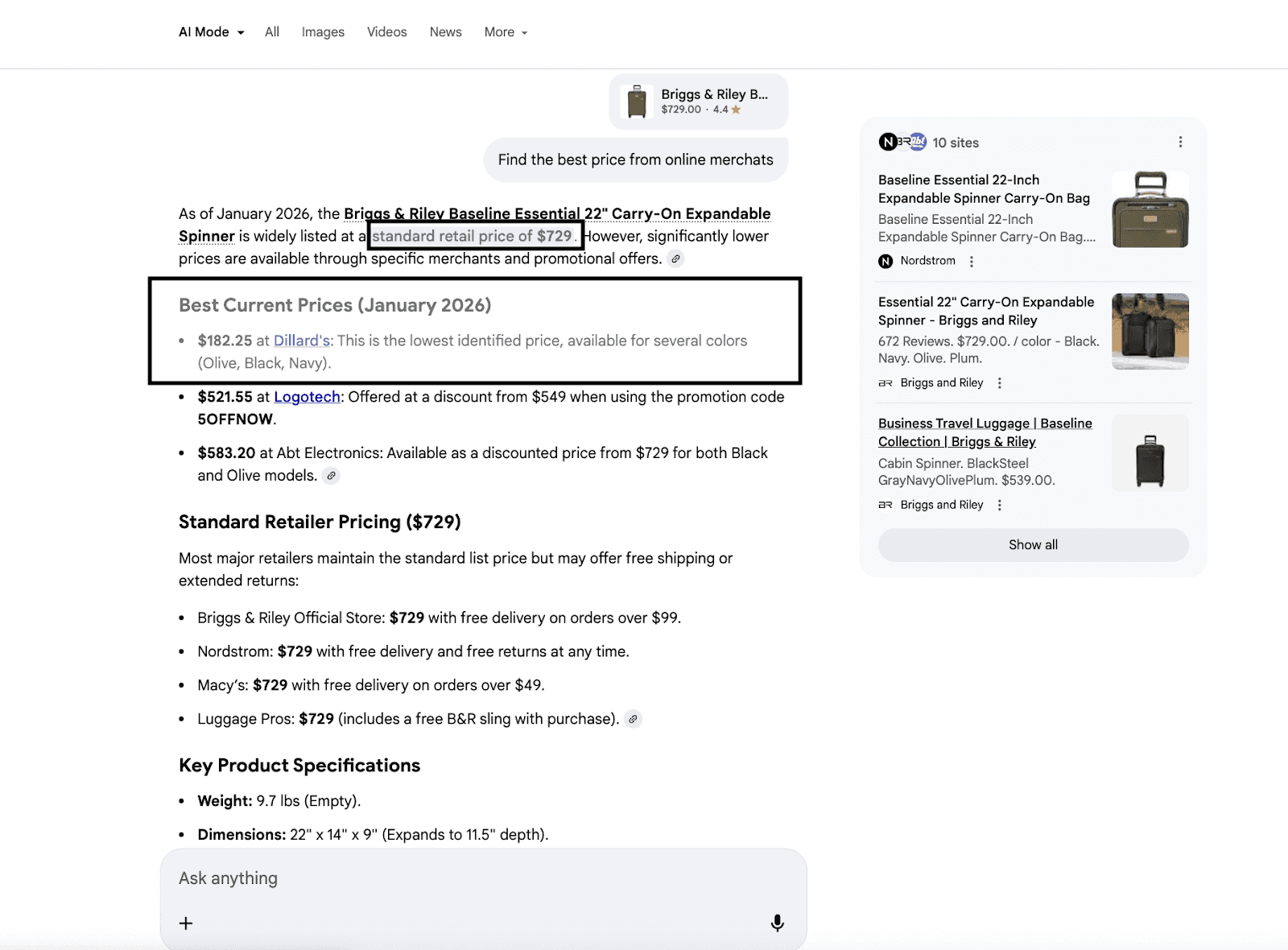

Select your chosen item and compare prices across different merchants. Here we go with Briggs & Riley:

Checking that product box, we ask AI mode to find the merchant with the best price, Dillard's at ~$182:

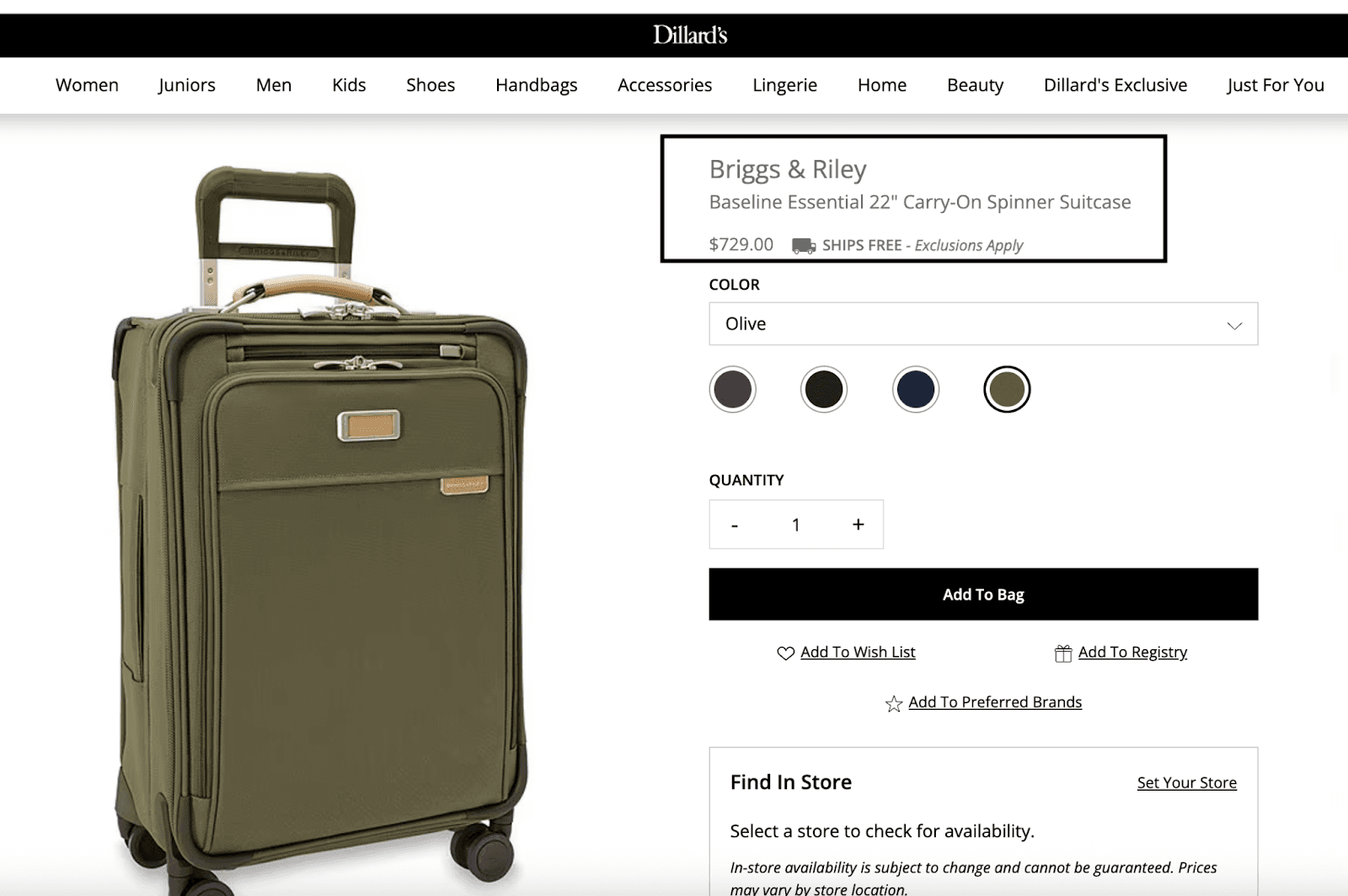

Click through to the merchant and you’ll often find a completely different price on their website. AI Mode said Dillard’s has the suitcase for $182 but it’s actually $729:

This friction explains why agentic commerce hasn’t exploded yet: the experience is novel, but it doesn’t fully remove the work or risk for the user.

What problem is UCP trying to fix?

UCP aims to eliminate this disconnect by letting AI agents talk directly to merchants’ live systems via standard capabilities, rather than scraping. In theory:

If merchant product data, inventory, and pricing are accurate and UCP‑exposed, AI Mode (and other agents) can query them in real time.

When the agent shows a price or delivery promise, it’s backed by a fresh, negotiated offer, not a scraped guess.

When the user says “buy this one,” the agent can complete the checkout inside the assistant with the merchant as the true merchant of record.

That is the difference between “AI that recommends” and “AI that reliably buys.”

The big open questions about UCP

There still is a lot we simply don’t know about UCP. It solves the technical interoperability problem, but raises new strategic questions for every retailer and brand.

1. Will UCP merchants be prioritized in AI Search?

It’s hard to imagine that agents will treat UCP‑enabled and non‑UCP merchants as equals. From the model’s perspective, UCP merchants are:

Higher fidelity: Live price and inventory, fewer surprises.

Lower risk: Contracts, SLAs, and clearer obligations.

Easier to transact with: Unified capabilities for checkout, returns, and support.

Even if the official line is that ranking is “neutral” and based on user value, UCP participation is likely to become a strong eligibility and quality signal for shopping ranking in Google AI Mode and Gemini. In other words, non‑UCP merchants may still appear in research‑type answers, but UCP merchants could dominate transactional flows.

2. How “vendor‑neutral” will UCP really be?

The protocol is described as vendor‑neutral and payment‑agnostic, and structurally that’s true, because it doesn’t force you into a single PSP or wallet. But ranking and monetization are separate layers. Over time, expect:

Organic ranking driven by relevance, sentiment, and performance.

Coexisting paid formats where merchants can bid to increase visibility or preference in certain slots, much like today’s PPC, but framed as “agent influence” rather than raw ad position.

The strategic tension is clear: if UCP becomes the default commerce route, whoever controls the ranking and paid allocation on top of it controls a massive share of downstream demand.

3. How could UCP fit into high‑consideration research?

For high‑ticket or high‑risk purchases (TVs, laptops, long‑haul travel), users don’t just want a correct price, they also want to understand tradeoffs. In those cases, UCP is necessary but not sufficient:

UCP handles up‑to‑date offers, configuration options, and purchase/return flows.

Separate research fan‑outs gather review articles, benchmarks, forums, and long‑form UGC.

The agent blends both layers. First, it forms an opinion (what matters, what’s good), then calls UCP to fetch concrete offers and execute the chosen option.

This means that even in a UCP world, investing in reviews, buying guides, research content, and UGC remains critical. These efforts will still feed and fuel research fan‑outs rather than ending at “click to merchant.”

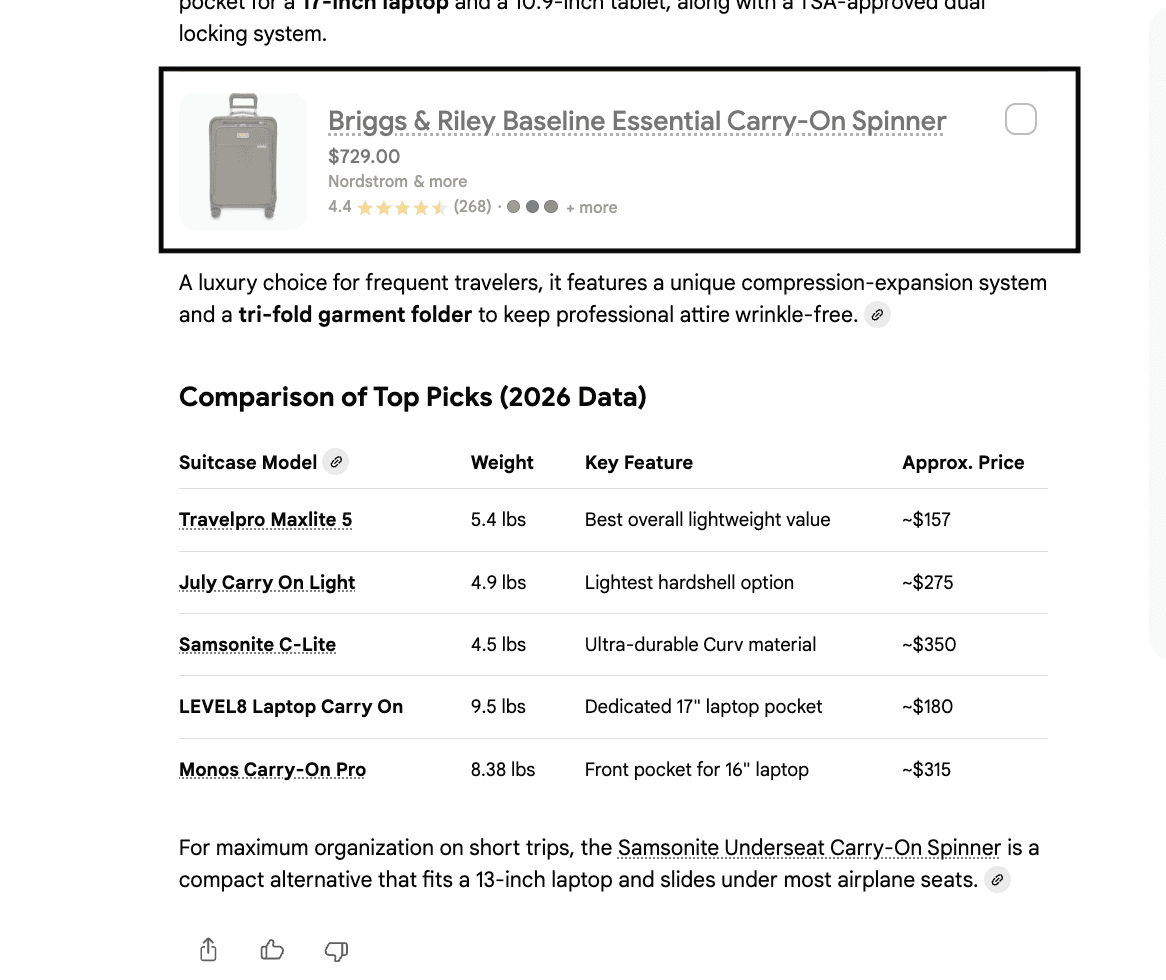

How products and merchants are likely to be ranked

The billion‑dollar question is how agents will rank merchants and products once UCP is widely adopted. While no one publishes the exact algorithm, several forces are almost certain to matter.

Mutil-level sentiment as the new PageRank

Think of three overlapping/interactive sentiment scores:

Product sentiment score: What users and experts say about specific SKUs, quality, fit, durability, satisfaction.

Brand sentiment score: Long‑term perceptions of the brand, trustworthiness, values, consistency, service.

Merchant sentiment score: How well the merchant performs on fulfilment, support, returns, and fairness.

These scores could be constructed from:

Reviews (ratings + text), Q&A, and photos.

Support interactions and complaint data.

Editorial content (reviews, roundups, buyer’s guides).

Behavioural data (conversions, returns, reorder rates).

UCP gives the agent a structured way to act (show, add to cart, buy, return). Sentiment graphs tell it who deserves to be acted on.

Multi‑fan‑out logic behind a single answer

Under the hood, one user query like “Find me a carry‑on suitcase under $500 and buy the best one for me” might trigger the following queries:

Product‑context fan‑out

Retrieve what matters for carry‑on suitcases (size rules, weight, durability, wheel types).

Aggregate advice from guides and reviews.

Agentic shopping fan‑out

Query UCP merchants for eligible SKUs, prices, availability, shipping options, and return policies.

Filter by constraints (under $500, available near the user, arrival in time).

Sentiment and source fan‑out

Evaluate product, brand, and merchant sentiment for candidate options.

Check which sources (sites, reviewers) support the recommendation.

Ranking and decision

Score combinations based on constraints + sentiment + predicted satisfaction.

Choose the offer (product–brand–merchant) with the best overall value and lowest risk.

The user sees only a concise answer and a one‑tap checkout, but behind that is a layered ranking stack that retailers will need to understand and influence.

Why an AI‑first strategy is now essential

In this environment, it’s not enough to “be present” in search or marketplaces. You need a deliberate AI‑first strategy that covers data, sentiment, and measurement. Here are a few ways you can prepare.

1. Make your stack agent‑ready

Implement UCP (and ACP where relevant) so agents can see live prices, inventory, shipping, and returns.

Ensure catalog data is complete, clean, and structured with attributes, variants, compatibility, and rich descriptions.

Tighten operational SLAs so merchant sentiment is aligned with your brand promise.

Without protocol support and clean data, you simply won’t be eligible for the best agentic opportunities.

2. Treat sentiment as a performance metric

Track product, brand, and merchant sentiment at a SKU and category level, not just aggregate star ratings.

Invest in post‑purchase experience, support, and fair policies to reduce negative events that models pick up.

Proactively encourage genuine reviews and UGC that highlight the attributes you want agents to notice.

In the same way PageRank rewards credible links, agentic ranking will reward consistent, verifiable customer satisfaction.

3. Adopt AI‑first analytics and GEO

Traditional analytics and SEO tooling were built for clicks and blue links, not for answers, agents, and embedded checkouts. AI‑first analytics platforms are emerging specifically to:

Show how often and where your brand and products surface in AI answers.

Reveal which sources and prompts drive those mentions.

Help you test and measure the impact of changes in content, pricing, and protocol integrations on model behaviour.

Understanding your “AI graph”, i.e. how models talk about you and your competitors, is quickly becoming as important as understanding your web analytics.

Key Takeaways: Another strategic win for Google (and a new playing field for everyone else)

Because UCP is co-designed and aggressively pushed by Google (with Shopify and major retailers in the mix), it gives Google a powerful position in the agentic commerce stack. Google can:

Own a key piece of the interoperability layer used by many agents and merchants.

Get first-mover advantage by launching in Gemini and AI Mode first.

Leverage its Shopping Graph and AI Mode as the most complete UCP‑backed surface.

Potentially expand monetization at the ranking layer without touching the open spec.

But this is not a closed world. Open standards and competing protocols (like OpenAI/Stripe’s ACP) mean retailers and brands can and should play in multiple ecosystems. The consistent requirement across all of them is the same:

Clean, structured, protocol‑accessible commerce data.

Strong product, brand, and merchant sentiment.

An AI‑first analytics loop that shows what the models are actually doing.

The MCP of commerce is here. The bigger question now is not whether the agents will come, but whether your products, brand, and merchant experience will be the ones they choose when they do.

Remember to follow both Peec AI and myself on LinkedIn for future analysis.

Useful resources and further reading:

Google Developers Blog – How Universal Commerce Protocol (UCP) works under the hood from a developer’s perspective

Google Merchant Center – Universal Commerce Protocol (UCP) Guide for Merchants

UCP.dev – An general overview of the goals of Universal Commerce Protocol (UCP) from the official site.

UCP.dev – Core Concepts for getting started with UCP from the official docs.

Shopify Engineering – Co-developer Shopify discussing Building the Universal Commerce Protocol

Shopify - More General Guide to UCP

Shopify – Discussing the Agentic Commerce Platform / AI Commerce at Scale